Wishing for record-high stock prices

Over the past three decades, Korea has enjoyed an annual average economic growth rate of 8.6 percent and has emerged as the world's 11th largest trading nation. In less than two generations, the nation has established itself as one of the world's leading shipbuilders and manufacturers of electronics, semiconductors and automobiles.

International financial markets positively regarded Korea's economic achievements, including sustained high growth, moderate inflation, high national savings, nominal external deficits and significant government budget surpluses. Recently, however, these impressive accomplishments have been overshadowed by the difficulties of several major conglomerates and financial institutions. These failures raised doubts among foreign investors and led to the serious liquidity crisis in late 1997. The crisis also created a serious unemployment problem.

However, following the change of government in 1998, Korea renewed its resolve to work with the IMF to fully implement comprehensive reform measures. As such, Korea was determined to adopt stringent adjustment measures to overcome the economic crisis.

The new leadership took steps to promote reform in the financial, corporate, public and labor sectors with a view to restoring and strengthening foreign investors' confidence as well as maintaining a commitment to a free-market economy, restructuring of the chaebol-based system, and increasing flexibility in the labor market.

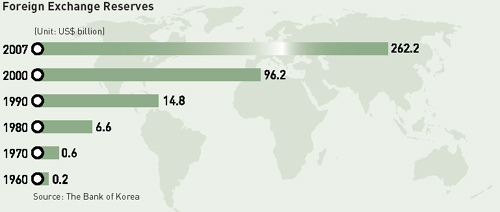

The nation's foreign exchange reserves that totaled a mere US$20.4 billion as of the end of 1997 rose to $262.2 billion as of the end of 2007, and the nation was able to repay all the $13.5 billion rescue loan from the International Monetary Fund. The IMF Executive Board on December 16, 1999, declared that the foreign exchange crisis in the Republic of Korea was completely resolved. Korea's credit rating, meanwhile, has been restored to investment grade.

Financial Restructuring: A modern, market-based economy cannot function efficiently without dynamic and well-supervised financial institutions. The Financial Servics Commission (FSC), which serves as a regulatory mechanism to establish universal banking practices, has created a new system of prudent regulations and supervision as well as a schedule for reform implementation.

In the process of financial sector reform, the Government has closed a number of non-viable financial institutions. Other viable banks are following through on the strong remedial actions imposed by the FSC to further improve their soundness. Korea's non-bank financial sector also underwent restructuring. As a result of these restructuring efforts, just over 40 percent of all financial institutions nationwide ― a total of 867, including savings banks and credit unions ― have been dissolved since 1997. Korea had 1,377 financial institutions in operation at the end of 2006.

Corporate Restructuring: In the corporate sector, overall results of restructuring have been quite positive. The debt-equity ratio of the manufacturing sector has improved dramatically, from 396% in late 1997 to 81.5% in September 2006. And the "too-big-to-fail" myth disappeared while many of the 30 largest conglomerates were sold, merged or liquidated. Rules for transparent and responsible management have been established and reinforced through the appointment of outside directors, the introduction of audit committees and the obligatory publication of combined financial statements.

The purpose of corporate reform is to enhance the productivity and growth potential of the Korean economy by establishing an efficient and fair market.

The gold-collection campaign went beyond being a simple symbolic gesture of patriotism. Countless Koreans participated in the country's campaign to help the government rebuild its financial reserves while enduring painful economic hardship.

Corporate structural reform will continue based on the following principles.

First, to enhance management and accounting transparency, it is necessary to focus on constructing a market-friendly oversight system, gaining the trust of market participants. Second, corporate reform should be pursued consistently. Until management transparency meets global standards, corporate restructuring should be promoted on an on-going basis.

Steps to bolster transparency and soundness of corporate governance will be carried out and reinforced. The management monitoring system will be strengthened within companies by enhancing the role of the audit committee, the board of directors and the rights of minority shareholders. To root out illegal practices such as deceptive accounting and stock price manipulation, class action lawsuits for the securities sector was introduced in January 2006.